The Tech Powering SaucerSwap

If you’ve ever wondered what’s going on under the hood of SaucerSwap, here’s the quick version: it’s a decentralized exchange (DEX) built on Hedera—and that choice isn’t just for show. Hedera runs on a technology called Hashgraph, which flips the script on how most blockchains work. The difference has real consequences for how fast, cheap, and reliable a platform like SaucerSwap can be.

Not built on blockchain

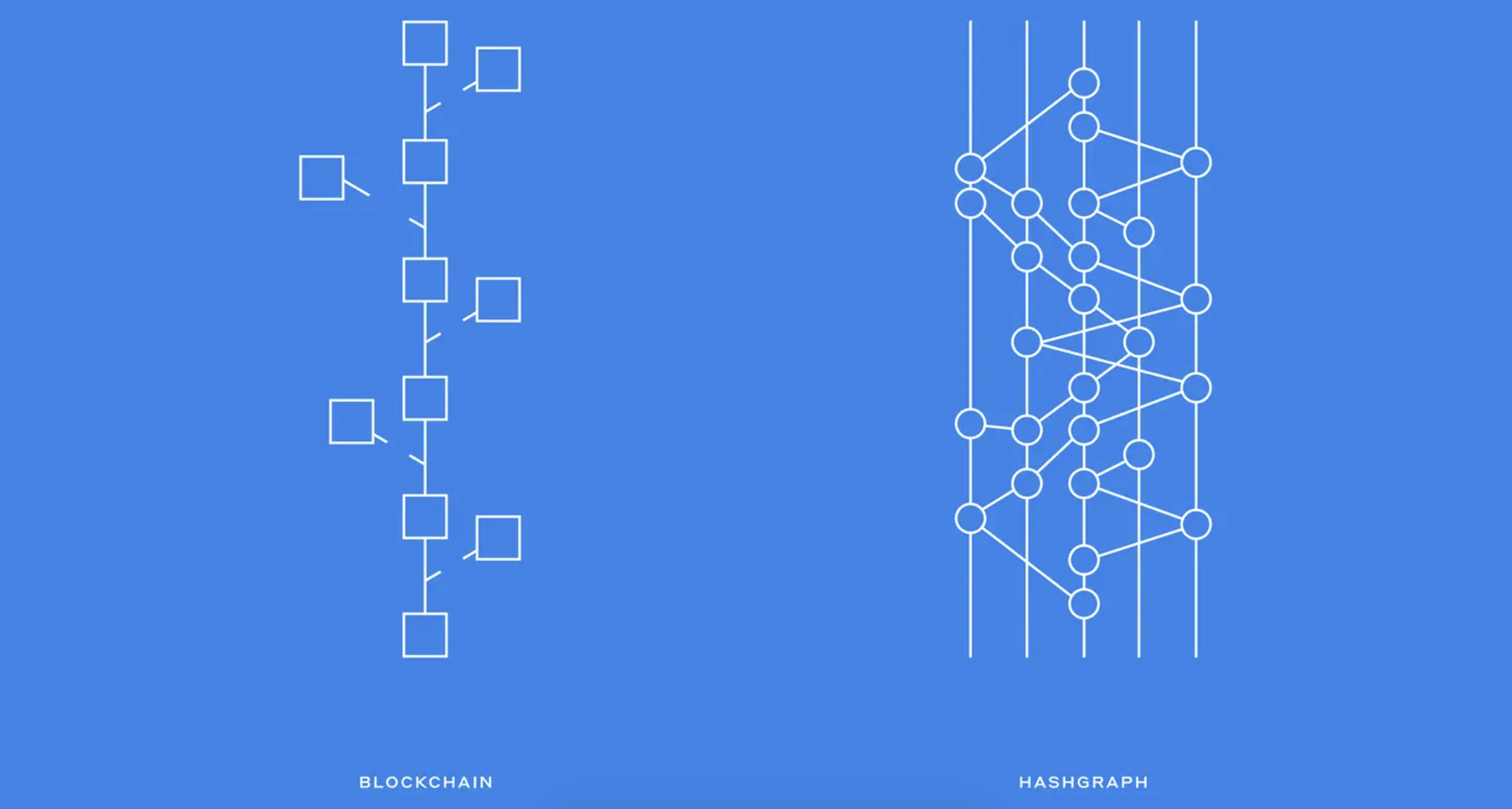

Let’s back up for a second. Most DEXs reside on Ethereum or similar chains. That means they rely on traditional blockchain architecture: a chain of blocks, added one after the other, with each block holding a bunch of transactions. It’s a tried-and-true system, but it has its limits, with network congestion, high fees, and latency being the big ones.

Hedera’s Hashgraph works differently. Instead of blocks, it uses a directed acyclic graph (DAG)—a data structure where transactions aren’t stacked linearly, but spread out and recorded in parallel. Techies use a gossip-about-gossip protocol here, which means every node quickly shares info with random others. Over time, the whole network has a complete picture of what happened and when, with no mining, leader, or lag.

The way Hashgraph handles consensus is key. Every transaction comes with a timestamp, and the network uses a virtual voting mechanism to agree on the order of events. That’s how it moves so fast—thousands of transactions per second, and everything settles in seconds instead of minutes.

Real-time settlement, low fees

For a DEX like SaucerSwap, the Hashgraph technology makes a big difference. Trades get confirmed almost instantly. While slippage is still largely a factor of liquidity and trading volume, it's much lower. And it's practically impossible for bots to exploit transaction delay windows. The entire trading experience feels snappier and more predictable, even when the market’s moving fast.

The tech also leads to lower costs. Because no miners compete for block space, gas fees on SaucerSwap are low and predictable. Think in terms of fractions of a cent. The hashgraph tech opens the door for microtransactions and lower-volume activity that would be priced out on other platforms. You don’t have to think twice about trying a swap just to see how a token behaves. And all fees are fixed and denominated in USD-equivalent HBAR.

Predictable performance is another upside. Since Hashgraph isn’t battling network congestion in the same way as other chains, you don’t get stuck waiting for a transaction to go through during peak times. The throughput is consistent, and that predictability is worth a lot in a trading environment.

Native token support via HTS

SaucerSwap is tightly integrated with Hedera Token Service (HTS), which handles the basics—creating tokens, transferring them, freezing or wiping them—without the need for smart contracts. It’s native, fast, and cheap. So, for most token operations, SaucerSwap can skip the overhead of smart contracts and rely on HTS to do the heavy lifting.

But when it comes to more complex functionality—things like routing trades across multiple pools, setting custom logic for incentives, or interacting with other DeFi protocols—SaucerSwap taps into Hedera’s Smart Contract Service. This service is EVM-compatible, meaning developers can write in Solidity and build the kinds of applications they’re used to building on Ethereum.

The difference is that those smart contracts run on Hedera’s Hashgraph under the hood, so you still get low fees and high throughput.

Final thoughts

The entire SaucerSwap setup helps make operations smooth for users and developers. Less friction, fewer surprises. It’s not out to reinvent DeFi, but it shows what DeFi can look like when you build it on something faster and more scalable right from the start.

So while you could use SaucerSwap without knowing a thing about DAGs, Hashgraph, or the rest of the tech stack, understanding what powers the DEX helps explain why it runs the way it does. Building something yourself on the DEX might make you rethink what kind of infrastructure you want under your project.